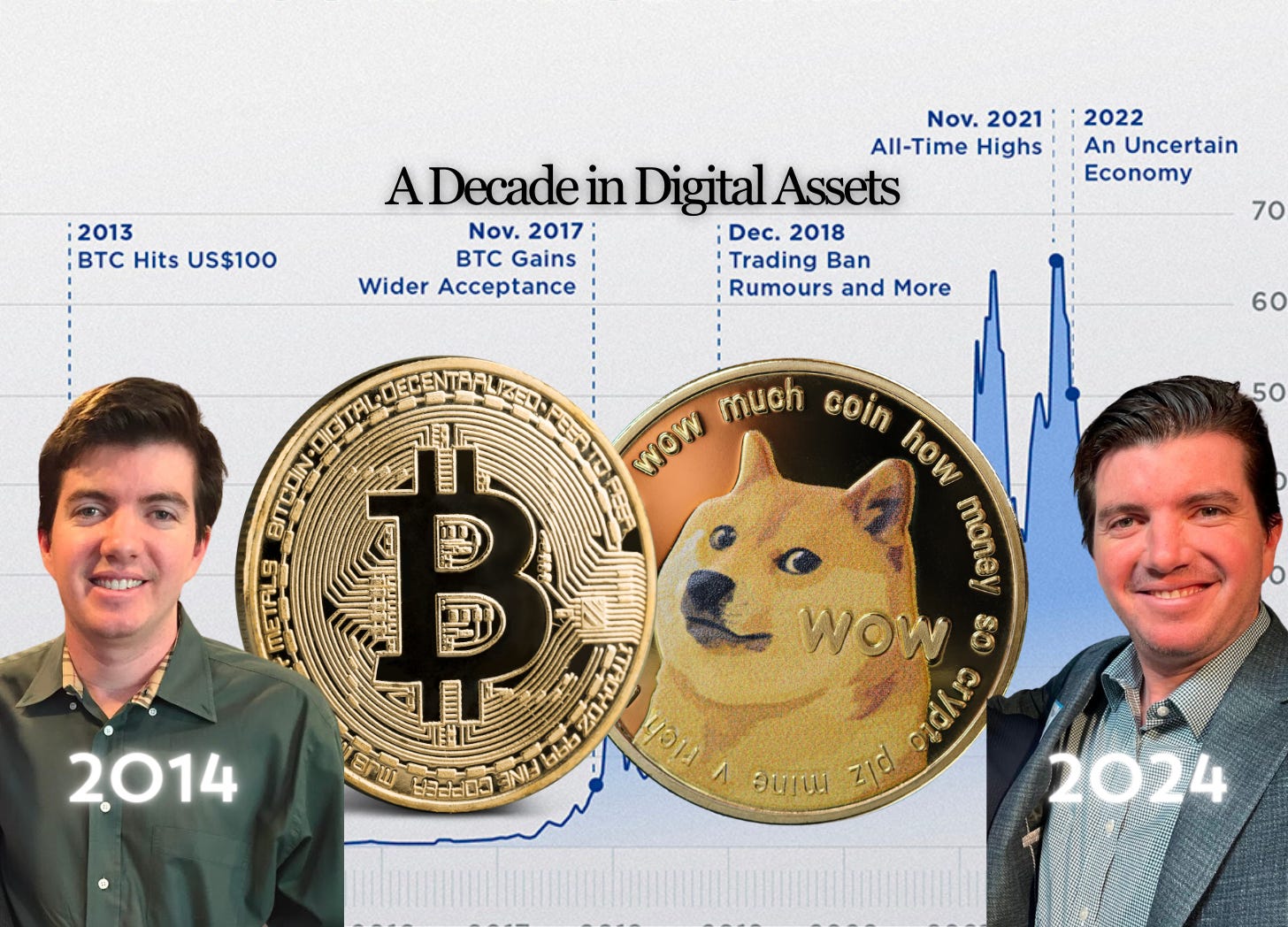

A Decade in Digital Assets: My Distributed Ledger Technology Journey

Ten years ago, the notion of placing a bet on the Super Bowl sparked my interest. My uncle, a devoted Seahawks fan, was already confident of victory before the game even began. However, living 300 miles away in sunny San Diego, I assumed I was out of luck. Then, while tuned in to AM 760 sports radio, the host mentioned betting with a platform called Bodog, which facilitated money transfers for Californians. If it was good enough for the AM Sports Radio host, it was good enough for me!

When I visited Bodog, I found that I could either send a Moneygram to someone in Nicaragua, requiring that I label them as a family member, or utilize a payment method known as Bitcoin.

I looked up "bitcoin," then went to LocalBitcoins, where I met with someone, exchanged $100, and received $100 worth of BTC.

The bet ended in success, with a convincing 43-8 victory (apologies to my friends in Denver). I cashed out my $190 in Bitcoin, converted $100 back into cash, and closely monitored Bitcoin's progress throughout the year. I liked the ideals that drove Satoshi Nakamoto after reading the white paper and his/her/their posts on Bitcointalk.

Being a full-time coder specializing in front-end applications, I happily spent my days coding websites. However, I noticed that the smartest and most eccentric friends I had were drawn to Bitcoin and other cryptocurrencies, often referred to as "altcoins."

I delved into Gitbooks, Reddit, and numerous online resources to deepen my understanding of the individuals propelling the evolution of the next stage of the internet and the complexities of its operations.

I was particularly intrigued by the fact that individuals who weren't necessarily interested in coding or distributed computing were embracing the movement against the traditional banking system, government overspending, and corruption. They viewed bitcoin or borderless digital assets as a safeguard against governments gone wild.

I appreciated the concept that anyone could participate in the proof-of-work consensus mechanism by offering their computer's computational power to safeguard the network. This involvement entailed competing against other computers to solve a mathematical problem, with the chance of being randomly rewarded for their efforts, thus incentivizing miners.

I admired Bitcoin's resilience against what's known as a 51% attack, where a malicious actor or group controls over 50% of the total computing power (hash rate) of the network. Unlike less valuable blockchains, Bitcoin was less susceptible to hackers routinely manipulating the blockchain ledger for their gain.

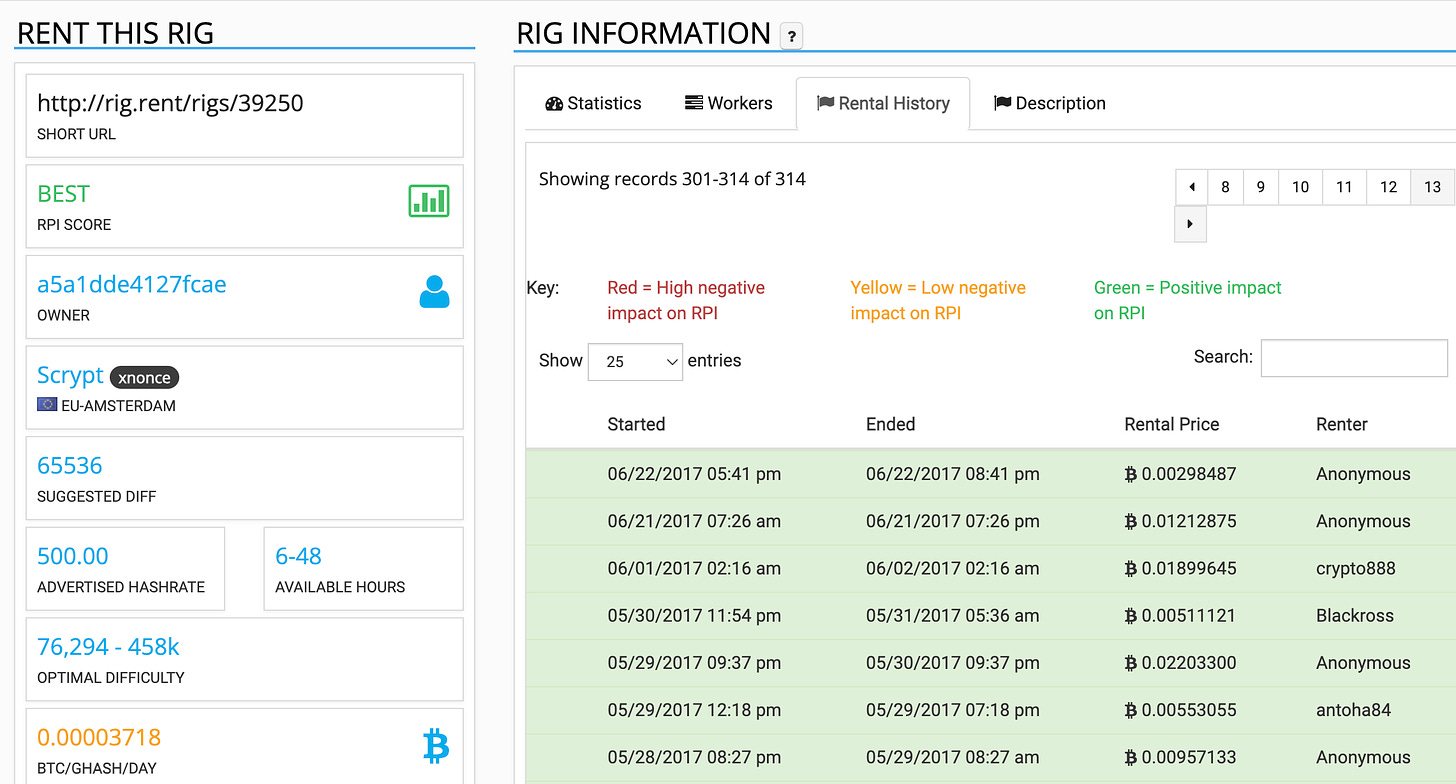

After overheating my laptop from mining to the point where I had to wrap it in ice, I turned to short-term cloud mining platforms. These platforms allowed me to rent computational power from remote systems to mine Bitcoin and other cryptocurrencies.

I appreciated how altcoins expanded upon the progress achieved by Bitcoin and explored further applications intended to provide practical value. Dogecoin, one of the earliest instances, employed a meme featuring a dog to humorously highlight the abundance of cryptocurrencies and their relatively low creation costs, all while garnering support from its community.

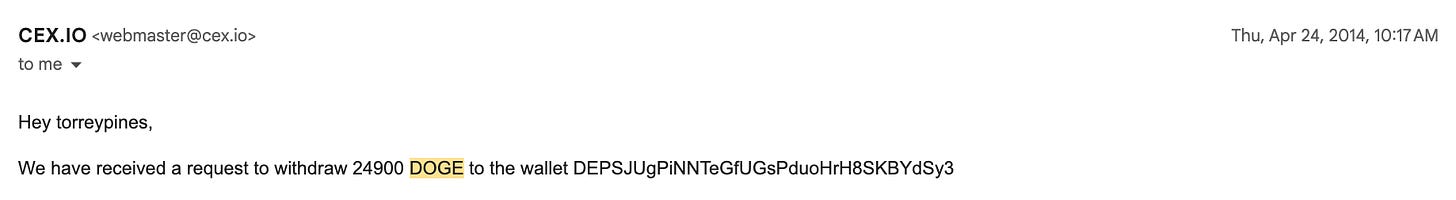

What attracted me the most were the negligible fees linked to sending and receiving coins digitally, along with the affordability of withdrawing funds from exchanges. I made it a habit never to go to bed without moving all my crypto off exchanges, a precaution that proved invaluable when FTX collapsed.

Back when these transactions occurred, 24,900 Doge equated to $10. Today, that same amount would be valued at $2,121, reaching a peak of $18,500.

Although Bitcoin hasn't experienced the same staggering growth as Dogecoin, it has still surged from $310.74 when I began to $52,000 today.

Although Bitcoin has garnered the majority of attention in terms of value, I reject the notion of maximalism tied to any specific coin and strongly advocate against prioritizing personal gains over intellectual integrity. If a blockchain project is delivering value to the community, it merits attention and consideration.

This asset class is not a zero-sum game, and what has defined the first decade of blockchain is a prevailing belief that collective success benefits everyone involved. This ethos has fostered collaboration among companies in ways seldom witnessed in industries characterized by cutthroat competition.

To maintain the engagement of open-source enthusiasts and community-minded technologists, digital assets and the foundational technology of blockchain must embrace a model that encourages inclusivity, collective support, and shared success. This strategy will consistently challenge conventional systems and legal frameworks with on-chain alternatives.