Early Stage LA Foundational Essay

Greetings! I'm a tech university instructor and venture capitalist, proudly based in sunny Los Angeles, a city I love for its swagger, style, and the thriving tech scene in Silicon Beach!

The way LA's skyscrapers reach out to the sea is magical to me, symbolizing a meeting point of ambitious dreams and vast, uncharted waters. When I look at downtown Los Angeles, I see more than just buildings; I see a bustling hub of creativity and innovation, pulsating with the lifeblood of new business ventures. The ocean, meanwhile, whispers tales of exploration and adventure, its waves echoing with the promise of endless opportunities.

LA looms large in media, fashion, science, and shipping, coupled with its growing status as a tech hotspot, and it fills me with pride and excitement. It's a city that's not just living but thriving by leveraging its unique strengths.

I'd like to share a bit about my perspective on investments, which I'm passionate about. The investors I look up to are those who understand the importance of playing to their strengths. They avoid the temptation of venturing into unfamiliar territories and achieve success with a humble approach.

For me, humility is anchored in intellectual honesty. It's about being true to oneself and consistently reevaluating one’s fundamental beliefs and strategies. In the dynamic world of tech entrepreneurship, I've learned that there's always something new on the horizon, and best practices are continuously evolving. This mindset keeps me adaptable and in tune with the latest technological trends and innovations.

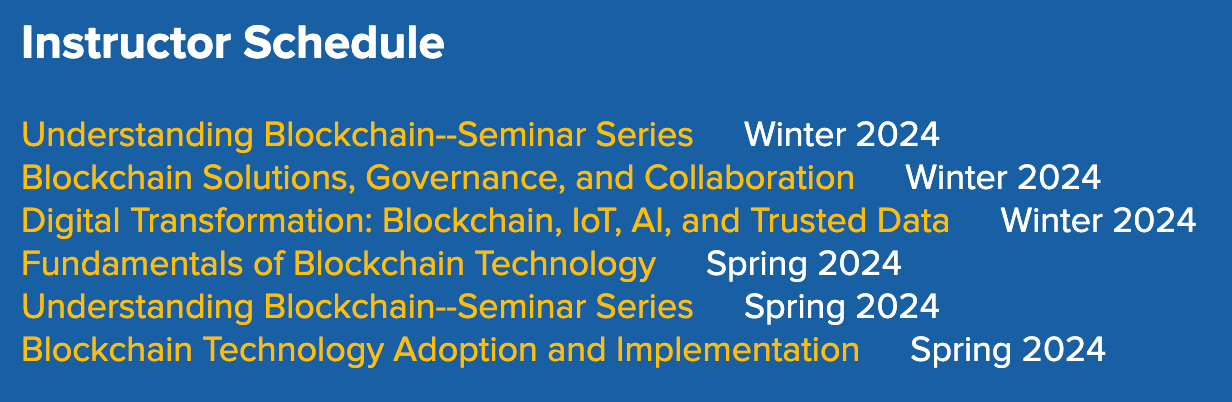

In the classes I teach at UCLA UNEX, I emphasize the importance of setting clear goals and drawing inspiration from the success stories of others. I encourage my students to study the paths of their role models, to understand and even reverse-engineer their journeys to success.

This approach is more than theoretical; it's about getting hands-on and practical. I present my students with real-life case studies, enabling them to analyze the successes and failures of various businesses. Through this method, they learn to understand the reasoning behind key executive decisions, evaluate their outcomes, and consider alternative approaches that could have been taken. It's an empowering way of learning, providing insights into business and entrepreneurship.

I've taken this teaching approach further by incorporating interviews with founders and industry experts. This initiative has blossomed into an ongoing series of interviews, providing a platform for students to gain firsthand insights from those actively shaping the world of technology and business.

Much like entrepreneurship, investment requires a similar analysis and strategic thinking approach. It's about understanding that the lessons of the past often provide valuable insights for the future. Historical strategies and patterns tend to recur, albeit in modified forms. By studying these patterns and learning from both the victories and the mistakes of others, I've come to form a few broad-based conclusions. These have crystallized into three core convictions, shaping my perspective on promising and potentially disruptive investment domains.

1. Upgrading Financial Infrastructure: One of my guiding principles comes from a powerful statement by JP Nicols: "Banks have to upgrade themselves or risk being burnt to the ground."

I remember back in 2015, working with H&R Block and being astonished to find that they were still using MS-DOS, a system long outdated by over two decades. It was a classic example of the "If it ain't broke, don't fix it" mentality.

This mindset is prevalent in many traditional financial institutions. They've long operated on a simple model: collect interest or fees and enjoy the comforts of a stable, predictable business. However, the advent of fintech companies is disrupting this complacency, forcing the banking industry to reconsider and update its antiquated technologies from the 1970s.

These investments in modernization are leading to a surge of technological solutions aimed at improving accessibility, equity, and transparency in the banking sector. These solutions often leverage the capabilities of distributed ledger technologies. Businesses that establish a strong foothold in these emerging technologies, whether through patents, operational procedures, or widespread market adoption, are positioning themselves strategically for success in an industry undergoing a generational shift.

2. Process-Focused Execution: Marc Andreeson famously said, "If you're not embarrassed by the first version of your product, you've launched too late." This resonates deeply with me, reminding me of a lesson I learned in my senior year of high school. On picture day, we were hurried and warned against blinking. Overthinking it, I ended up blinking. It's a simple yet profound lesson: the fear of making a mistake often leads us to make one.

In business, as in life, it's crucial to focus on the process rather than just the result. My high school and college golf coaches taught me the power of positive thinking. Rather than focusing on what not to do ("Don't hit it into the trees"), we were encouraged to envision what we wanted to achieve ("Drive it down the middle for a perfect second shot"). This approach, championed by legends like Tiger Woods and Jack Nicklaus, involves visualizing success before it happens. I've found this strategy incredibly effective on the golf course and in business.

In my professional journey as a coder, I was tasked with competitive research and discovered how Polygon blockchain distributed millions in tokens as staking rewards to partner decentralized applications. Despite the risk of dilution, this strategy paid off by garnering significant developer support and forming key partnerships. This experience highlighted the importance of community building, especially in open-source ecosystems where underlying technologies have limited protection. Nurturing a strong community can be a decisive factor in gaining a competitive edge.

3. Milestone-Based Funding: In my seven years of management consulting, I proudly wore the hats of a problem-solver, idea generator, and reliable support system for founders during times of uncertainty and intense pressure. These founders often felt isolated while pioneering new market territory with cutting-edge technologies. Yet, I consistently identified parallels between their circumstances and fellow entrepreneurs navigating advanced technologies in their eras.

Founders often seek substantial funding to ensure stability, but this can also lead to increased pressure due to heightened expectations from investors. I advocate for a different approach: secure modest funding, prioritize revenue growth, and build trust with investors by achieving small, consistent milestones. This approach enables founders to demonstrate their capabilities and commitment, creating a transparent and trust-based relationship with their investors.

The JOBS Act revolutionized fundraising, liberating founders from the constraints of venture capital dependency and allowing them to explore various funding options without relinquishing control. I favor using instruments like convertible notes with fixed maturity dates or Simple Agreements for Future Equity (SAFEs) tied to revenue multiples or milestone-based timeframes.

I caution new founders against accepting capital with terms that undermine their position, such as liquidation preferences and preferred stock. Until a business gains momentum and founders have more bargaining power, they need to strive not only to retain as much ownership as possible but also to maintain equitable ownership terms with their venture partners. A valuable venture capital partner goes beyond providing financial support; they should offer crucial connections, offer much-needed advice during tough times, and assist in devising effective solutions when required.

As a tech equity analyst at Tech Coast Angels, the largest angel group in Southern California, we regularly saw situations illustrating the importance of aligned incentives and effective accountability measures. Some of the companies we invested in saw remarkable growth, with their revenue increasing up to 50 times. However, they often chose not to expand beyond a lifestyle business model or repay the capital investment, focusing instead on maximizing founder salaries. This experience highlighted the need for a balanced approach that grants founders the necessary freedom while charting a path to success that benefits both the capital partner and the founder, ensuring a positive outcome for all involved.

I'm incredibly proud to witness the evolution of Los Angeles into a major investment destination, boasting a diverse economy, thriving tech and entertainment sectors, and a strategic position in global trade. The city is rapidly transforming into an increasingly prominent tech hub, attracting innovative startups and established tech giants and fostering a vibrant entrepreneurial ecosystem.

If you're constructing a portfolio with a percentage allocated for capturing frontier technologies or are a tech-savvy founder with a passion for crafting solutions in B2B SaaS, FinTech, or distributed ledger technologies, let's do lunch where the hustle and bustle of the business world meets the serene backdrop of the beach. Let's talk about the future of business and technology with the soothing sound of the waves as our soundtrack!

Best regards,

Robert Mowry GP, Early Stage LA