The Inflation Shift: Institutional Investors Flee Alternative Investments for Liquid Assets

• Institutional investors, such as pension funds, are shifting away from long-term "alternative" investments like private equity and towards more liquid assets like bonds and bank loans due to rising interest rates and inflation, seeking quicker access to cash and better returns.

• The shift away from alternative investments is causing a cash crunch for retirement funds, making it difficult for companies to keep pace with their obligations to retirees, and leaving some pension funds with money tied up in "zombie funds" with slow or non-existent payouts.

The Rise of Liquidity

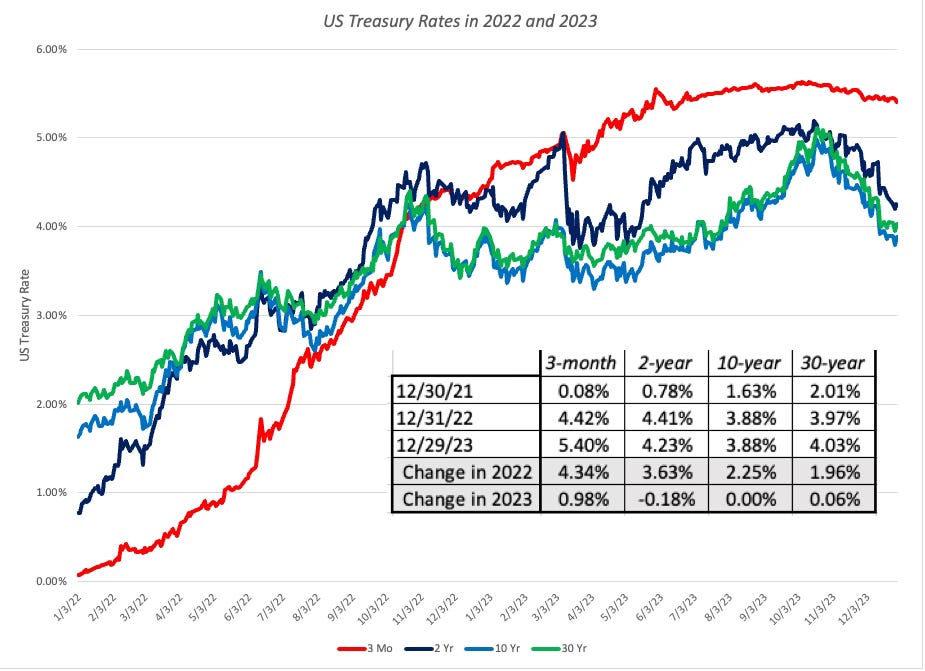

Institutional investing is experiencing a significant transformation, with many of JPMorgan's corporate clients pivoting away from long-term "alternative" investment portfolios. Instead, they are redirecting their focus towards more liquid assets like bonds and bank loans. This shift comes amidst rising interest rates, enabling these companies to achieve attractive returns through conventional investment avenues.

The move underscores a broader recalibration within the institutional investment landscape, where the allure of liquidity and stable returns from traditional assets has gained prominence. This strategic adjustment reflects a pragmatic response to evolving market conditions, highlighting a departure from the previous emphasis on alternative investments that are typically less liquid and potentially more volatile in the current economic climate.

The Consequences of Complex Investments

In recent years, numerous companies had committed substantial investments to private equity and other intricate strategies that tied up capital for extended periods, anticipating robust long-term returns. Yet, the prevailing inflationary pressures have reshaped this strategy, prompting institutional investors to prioritize liquidity and faster access to funds. Consequently, pension funds find themselves compelled to sell off their private equity holdings at reduced valuations, incur debt, or resort to expensive measures to secure immediate cash flow.

This shift underscores a pragmatic adaptation to economic dynamics, where the ability to swiftly mobilize capital outweighs the allure of potentially higher, albeit delayed, returns from illiquid investments. It reflects a strategic pivot within the institutional investment sphere, navigating towards flexibility and responsiveness in an inflationary market environment marked by heightened financial pressures.

The Cash Crunch

The impacts of these changes are substantial. With liquidity emerging as a critical issue, retirement funds are facing an escalating cash squeeze, presenting significant hurdles for companies aiming to fulfill their obligations to retirees. To cope with this challenge, many are exploring innovative financial products that enable managers to borrow against their less liquid assets to meet their financial commitments.

The strain on pension funds underscores a broader dilemma within the investment community, where the allure of high returns from less liquid assets such as private equity clashes with the immediate financial obligations of retirees. This mismatch heightens financial stress, as pension managers navigate how to fulfill obligations without the anticipated returns from long-term investments materializing as expected. The resulting cash flow constraints could potentially impact the sustainability of retirement benefits and necessitate difficult decisions regarding fund management and asset allocation.

The current situation represents a pivotal moment for institutional investors and the actuaries guiding their strategies, necessitating a reassessment of long-term investment approaches amidst economic changes. The focus on liquidity in pension portfolios signals a shift towards adaptable investment strategies that effectively balance risk and ensure the fulfillment of ongoing financial obligations, essential for maintaining stability in today's complex financial landscape.

The Decline of Alternative Investments

A survey conducted by Coller Capital reveals that close to half of private-equity investors find themselves entangled in "zombie funds" — funds within the private-equity sector that fail to deliver timely payouts, leaving investors in a state of uncertainty regarding their returns. This situation casts a shadow over an investment approach that was previously heralded as a straightforward choice for pension funds and the savings of workers planning for retirement.

The prevalence of these zombie funds underscores a significant challenge within the private-equity landscape, where investors face prolonged waits for expected returns, disrupting financial planning and potentially jeopardizing the perceived reliability of such investments. This development prompts a critical reassessment of investment strategies, urging stakeholders to weigh the allure of potentially higher returns against the risks posed by liquidity constraints and delayed payouts in a shifting economic environment.

The New Benchmark

The traditional benchmark of achieving a threefold return over a decade, accomplished by only about a quarter of large venture capital funds, is no longer deemed sufficient in today's economic climate. As inflation rates climb, investors are increasingly setting their sights higher, now seeking fivefold returns. This new expectation places a premium on flexibility and agility among fund managers who can navigate and capitalize on the evolving financial landscape.

This heightened demand for greater returns underscores a broader recalibration within venture capital, where achieving substantial profitability within shorter timeframes has become an imperative rather than a nice-to-have. Investors are recalibrating their risk-reward calculations, prioritizing investments that promise not only robust returns but also a quicker turnaround on capital deployment. This shift reflects a strategic response to inflationary pressures, where the ability to adapt swiftly and deliver superior performance is crucial to meeting investor expectations and maintaining competitiveness in the market.

The Impact on the Industry

The retreat from alternative investments serves as a stark reminder of the dynamic nature of the investment arena. With the backdrop of rising interest rates and inflationary pressures, institutional investors face a compelling need to adjust to shifting market dynamics and reassess their investment approaches. The era of committing capital for extended periods in pursuit of lofty returns is waning, prompting a pragmatic reassessment of investment goals.

In this evolving landscape, investors are urged to adopt a more realistic outlook, prioritizing investments that offer liquidity and stability amid economic uncertainty. This necessitates a shift towards strategies that can provide reliable returns without the prolonged lock-up periods characteristic of many alternative investments. By aligning their portfolios with these principles, investors can better position themselves to navigate and thrive in a volatile market environment.

If I’m a Pension Plan, What Do I Do?

To combat the relentless creep of inflation, I recommend a strategic investment approach that combines the stability of commercial real estate with the potential for growth offered by venture funds. This can be achieved through direct investment in commercial real estate, or by investing in a fund or custodian that specializes in this asset class, such as Northern Atlanta's 7% community bond. Additionally, partnering with emerging managers from reputable programs like Coolwater Capital or Kauffman Fellows can provide access to nimble and innovative investment strategies that are better equipped to navigate the changing market landscape.

These agile leaders are poised to surpass their counterparts by leveraging strategic thinking and a commitment to delivering outstanding returns. Furthermore, with minimal management fees, investors can be confident that the incentives of fund managers are closely aligned with their own interests.

In conclusion, the movement from alternative investments to liquid assets marks a pivotal trend that will shape the investment landscape in the years ahead. Institutional investors must ready themselves to adjust to evolving market dynamics and reconsider their investment strategies to fulfill their commitments to retirees while achieving robust returns.

The era of relying on complex and illiquid investments without certainty regarding their required return profiles relative to the risks involved is fading, prompting a pragmatic reassessment of expectations. This reassessment may involve discontinuing relationships with excessively large funds whose operations may no longer be sustainable.

Sources:

Pension Funds Go Cold on Private Equity - WSJ

Pensions Piled Into Private Equity. Now They Can’t Get Out. - WSJ