Pitchbook Estimates That 50% of First-time Fund Managers Won't Secure a Second Fund.

First-time fund managers play a crucial role in fostering innovation, supporting startups, and diversifying the investment ecosystem. However, despite their potential, first-time fund managers often face significant challenges that hinder their ability to raise a second fund.

As US market volatility rises, VC fundraising becomes tougher, with 2023 seeing a significant drop to under $67 billion raised, a stark contrast to the $100 billion raised annually in 2021 and 2022; LP caution and reduced capital deployment have concentrated investor funds in established-manager-led funds, leaving new managers struggling to attract capital for their second VC fund amidst challenges like portfolio down rounds and liquidity constraints, potentially leading to a significant portion exiting the market, underscoring the need to assess historical data to estimate the impact on the US VC ecosystem.

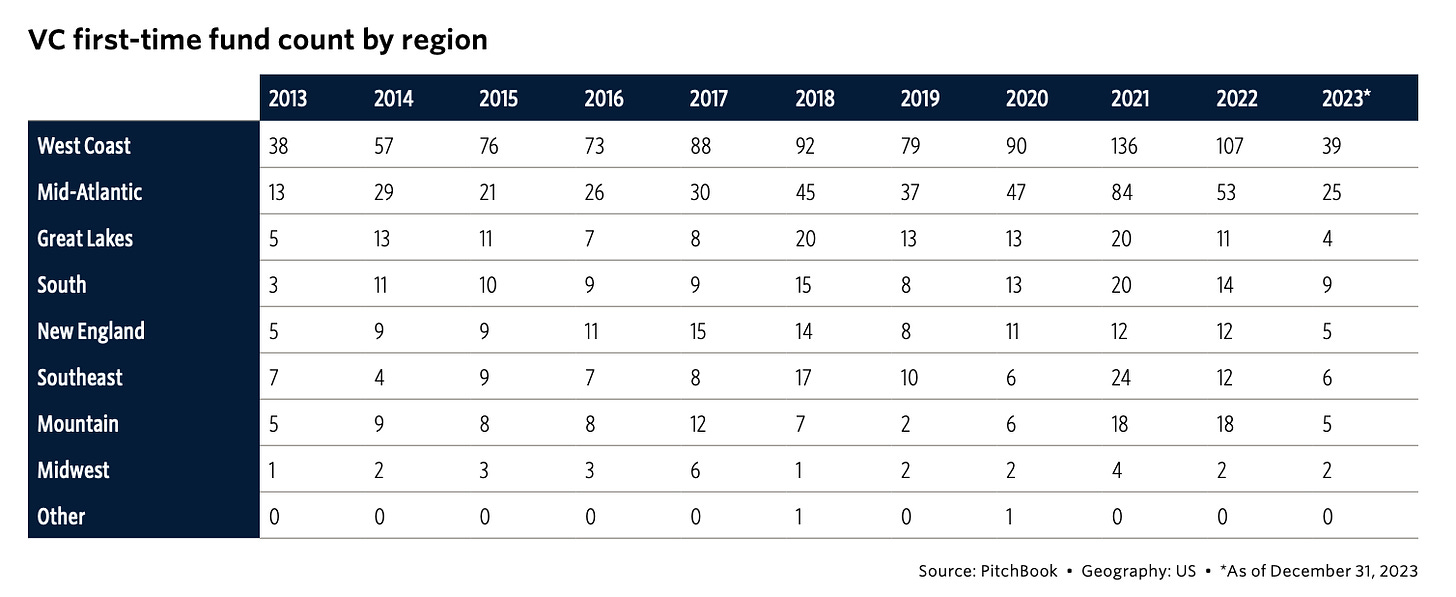

The surge in first-time fundraising, driven by near-zero interest rates and robust venture returns, has led to a significant increase in capital raised to $58.5 billion across 1,381 funds since 2017, fostering decentralization of VC activity and providing broader exposure for LPs, yet with LPs increasingly cautious, particularly towards new managers, the time between first and second funds has extended to 2.6 years in 2023, posing challenges for emerging managers and potentially impacting local ecosystems reliant on VC capital influx.

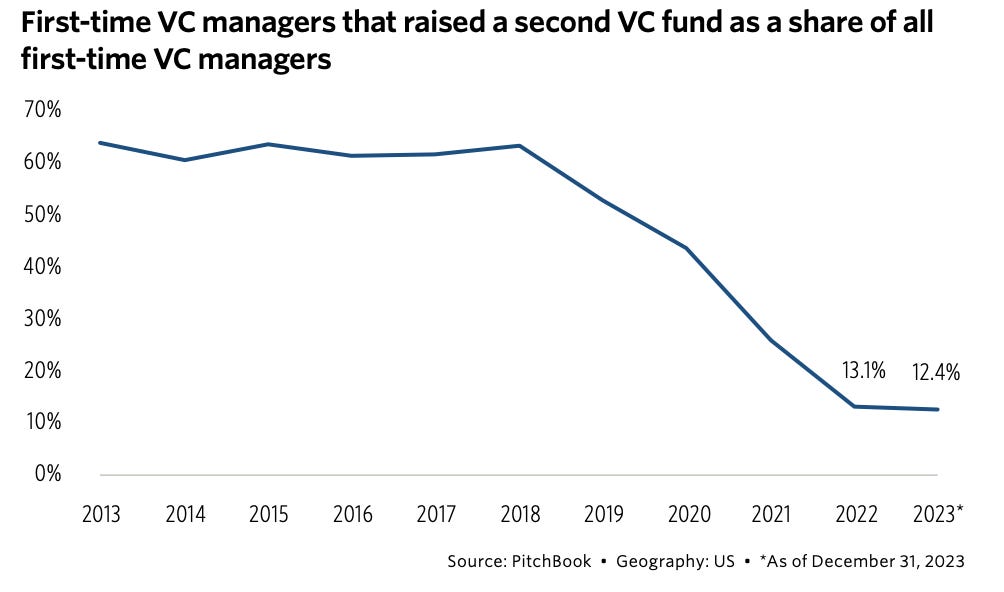

Estimating dropouts in the VC industry reveals that historically, 63.0% of first-time managers succeeded in raising a second fund, but with various challenges such as a surplus of first-time funds, volatile valuations, and a challenging fundraising climate, the likelihood of managers raising sophomore funds is expected to decrease, potentially leaving a significant number of managers unable to secure follow-on funding, with projections indicating that even if recent vintage funds achieve historical success rates, approximately 247 out of 667 first-time managers from 2019 to 2021 could face difficulties in raising subsequent funds, potentially impacting the VC ecosystem.

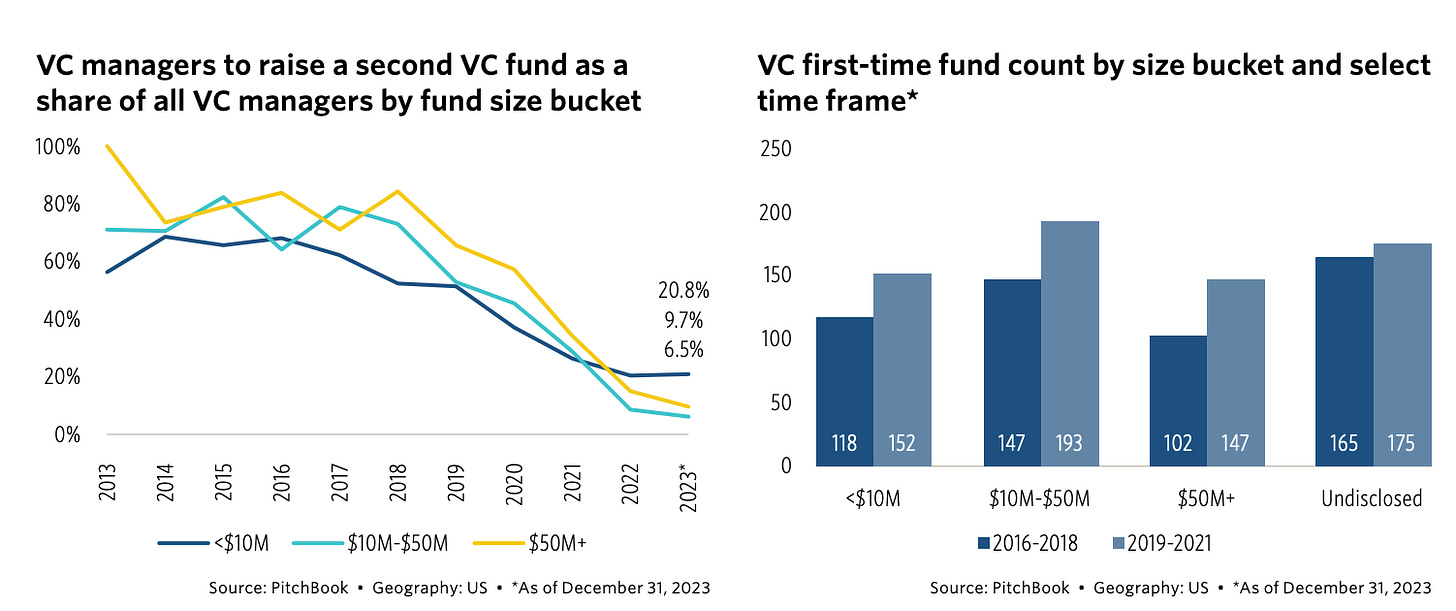

Historically, follow-on rates for first-time managers varied significantly based on fund size, with those raising over $50 million having the highest success rate at 76.7%, followed by managers with funds between $10 million and $50 million at 73.1%, those with less than $10 million at 64.6%, and managers with undisclosed fund sizes having the lowest success rate at 42.3%, while outside of California, New York, and Massachusetts, only 56.7% of first-time managers successfully raised a second VC fund between 2006 and 2018.

Challenges Faced by First-Time Fund Managers

1. Harsh Fundraising Environment: The VC fundraising landscape has become increasingly challenging, with LPs showing a preference for established managers with proven track records. The prolonged liquidity crunch and declining LP appetite for venture investments have made it difficult for emerging managers to attract capital.

2. Lack of Track Record: First-time managers lack a track record of successful exits or significant portfolio performance, making it harder for them to demonstrate their investment prowess to potential LPs. Without a track record, LPs may be reluctant to commit capital to unproven managers.

3. Market Volatility: Market volatility, exacerbated by economic uncertainties and geopolitical factors, adds another layer of complexity for first-time managers. Volatility can impact the performance of portfolio companies and decrease investor confidence, making it challenging to raise follow-on funds.

4. Extended Time Between Funds: The time between raising the first fund and attempting to raise a second fund has increased to a near-record 2.6 years. This prolonged fundraising cycle adds pressure on first-time managers to demonstrate interim fund performance and navigate market uncertainties.

According to PitchBook data, since 2017, $58.5 billion has been committed to 1,381 first-time funds managed by VC investors, representing a significant increase in capital raised compared to the previous decade. However, despite this surge in fundraising activity, the success rate of first-time managers in raising follow-on funds remains relatively low.

Historically, only 63.0% of first-time managers have been able to raise a second fund. Factors such as fund size and geographical location play a significant role in determining the success rates of first-time managers. Larger funds ($50 million or more) tend to have higher success rates compared to smaller funds, highlighting the importance of fund size in attracting LP commitments.

Implications and Future Outlook

The challenges faced by first-time fund managers have implications for the broader VC ecosystem. The concentration of capital within established manager-led funds limits opportunities for emerging managers and hampers innovation and diversity in the market. Additionally, the potential decline in capital availability in smaller VC ecosystems could hinder the growth of local startups and disrupt the decentralization of venture investing.

The potential repercussions of first-time fund managers failing to secure a second fund are multifaceted, with recent trends offering insights into their broader implications, including the likelihood of reduced dealmaking activity in smaller markets, which experienced a surge in fundraising that bolstered their ecosystems, particularly amid the COVID-19 pandemic, although historically, these markets have exhibited lower follow-on rates for first-time managers, with only 56.7% in California, New York, and Massachusetts managing to secure a second VC fund, indicating the critical role of local resources and long-term commitments to the venture capital strategy; however, in states with smaller VC ecosystems, such as Columbus, Ohio, Minneapolis, Minnesota, and Raleigh, North Carolina, where syndicate networks play a vital role due to fewer VC firms and funds, an increased fallout of first-time managers could pose significant challenges, potentially hindering their ability to sustain recent growth fueled by the continued fundraising of new firms.